April 29, 2022

The value of life insurance might be questionable among some, but the truth is, there are more facts than fiction when it comes to why or why not it is needed. Here are five common myths and the truth behind them. Let’s clear things up!

Myth #1: I’m young. I don’t have kids or dependents.

FACT: Whether you are a college student or out in the working world, it’s likely you have expenses or debts you’re responsible for paying such as student loans or monthly bills. You might not have kids, but you could possibly be a caregiver for aging parents. In any situation, should something happen to you unexpectedly, such as an unplanned illness, disability or death, your family will take on those responsibilities. Any property or personal savings could potentially go to debtors instead of your family. Considering life insurance can help alleviate this strain. Purchasing a policy while you’re younger & healthier could also save you money in the long run, as life insurance typically gets more expensive as you age.

Myth #2: It’s too expensive! It’s unaffordable!

FACT: Life insurance cost is often overestimated. According to a 2021 LIMRA and Life Happens study, most people overestimate the cost by up to three times but when you are younger and healthier, you can get a simpler plan to start and then add to your coverage over time. The four main factors that determine the cost include:

Age

Health

Policy Type

Amount of coverage you purchase

Myth #3: Life Insurance is only to pay for final expenses or debts.

FACT: Life insurance provides security and stability for those left behind after a loss. These expenses can include any immediate, ongoing, and future expenses such as:

Mortgages

College costs

Living expenses

Medical

Debt

Taxes

Giving your loved ones stability after you’re gone will help lessen the burden that comes with loss and gives them one less weight to carry in their time of grief.

Myth #4: I don’t need it. I don’t earn an income, I’m a stay-at-home parent.

FACT: Studies estimate the economic value of running a household is worth $178,2011 per year. The loss of a stay-at-home parent in a household can mean that the surviving spouse will now have to cover new expenses that were not needed before the loss such as childcare or household tasks like cleaning or grocery shopping. Life insurance for a stay-at-home parent might even allow the remaining surviving parents to take some time off work should they want or need to do this.

Myth #5: The process is long and complicated!

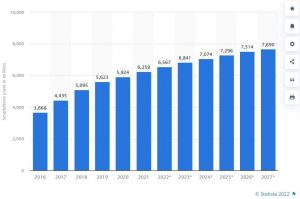

FACT: Our lives move fast these days. Now more than ever, we utilize mobile technology for almost everything in our lives. There seems to be an app for everything. Mobile phone usage statistics show that 90% of time spent on mobile devices is spent in apps, and there were 194 billion downloads of mobile apps in 2019.2

Number of smartphone users worldwide from 2016 to 2021 (in billions).2

Smartphone and app usage will only increase based on these statistics, and with access at our fingertips, life can become significantly streamlined and simple. Most companies are utilizing apps to give their consumers convenience and ease and insurance companies have also joined this movement. With mobile-based “easy apps,” you can get insurance with a few short clicks without stepping foot in an office. If you are unsure of what you need or how much, a life insurance calculator can easily help determine what’s right for your life.

Insurance companies have long been on the market and will remain there because of the value security provides. There are many reasons why someone may avoid purchasing life insurance, but with KSKJ Life’s policies, you can rest assured you and your loved ones will be taken care of the way you would want.

1) www.salary.com/articles/mother-salary 2) Statista.com

Looking for more information on a policy with KSKJ Life?

Connect with us today!